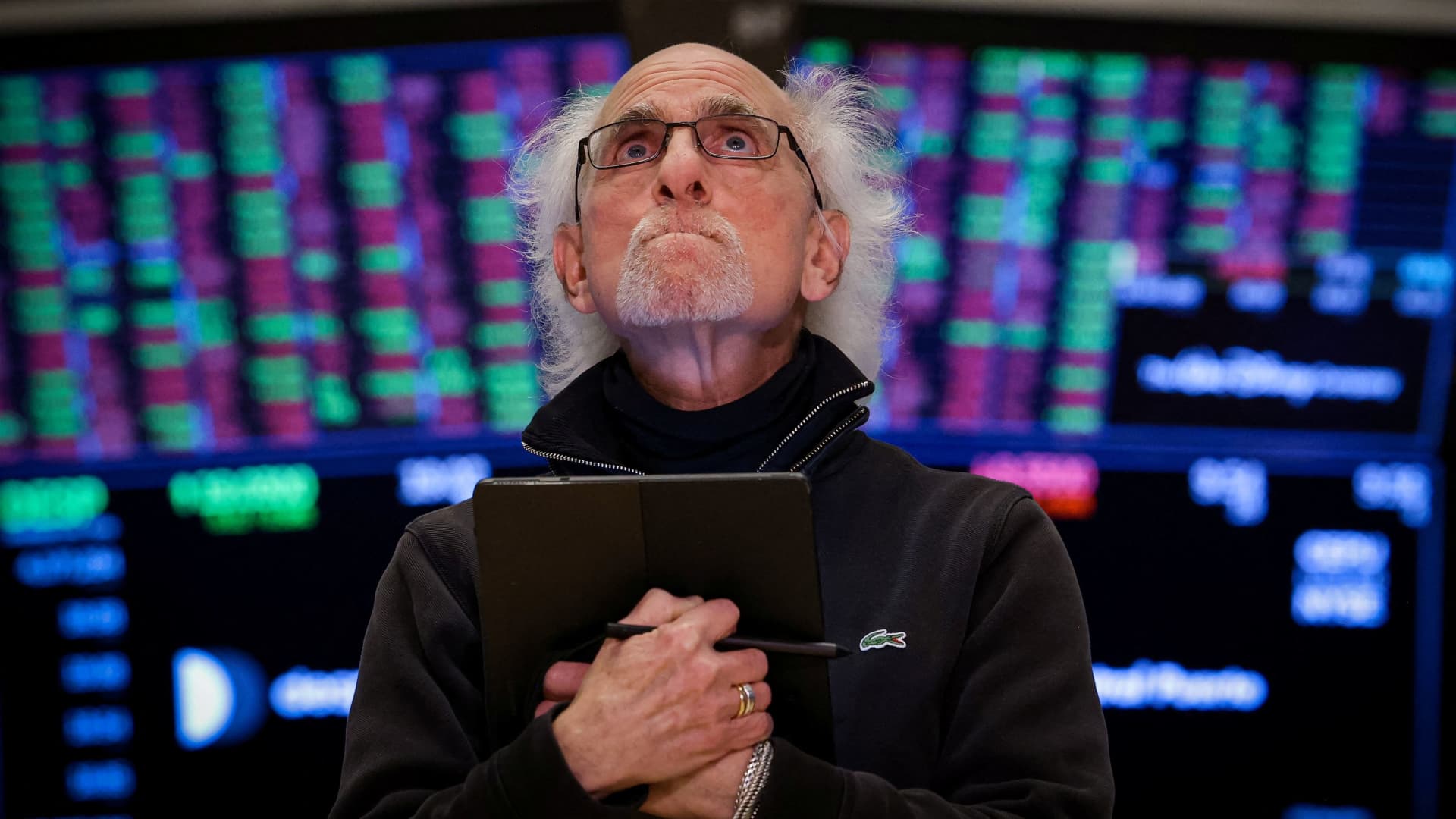

A trader operates on the floor of the New York Stock Exchange (NYSE) in New York City, USA on April 7, 2025.

Brendan McDermid | Reuters

Stock futures climbed on Monday evening S&P 500 as it proceeded to lower for three consecutive days following President Donald Trump’s implementation of tariffs.

Futures for the S&P 500 managed to increase by 0.9% Nasdaq-100 Futures also gained approximately 1%. Dow Futures rose 444 points, which is nearly 1.2%.

This shift follows another day of volatile trading on Wall Street.

- 30 stock Dow Jones Industrial Average The Blue Chip Index experienced a drop of more than 1,700 points, with a recovery of 349 points (0.9%) early in the session. The index fluctuated between highs and lows, reaching a difference of 2,595 points.

- The S&P 500 saw a decline of 0.2% after plummeting 4.7% during the session’s lowest points. The broad market index concluded the day over 17% away from its 52-week peak but briefly ventured into bear market territory during the session.

- Nasdaq Composite Investors purchased shares in key Megacap technology enterprises, incrementing by 0.1% with nvidia and Palantir. The Tech Heavy Index dipped over 5% at the session’s low.

At a certain point during Monday’s session, the stock surged to positive territory amid rumors on social media regarding a suspension of tariffs. However, the White House later informed CNBC that the 90-day tariff deferral discussions were “fake news,” leading to a market pullback.

Treasury Secretary Scott Bescente suggested in an interview with Fox News on Monday that tariff negotiations with various nations could extend into June. He mentioned that “probably nearly 70” countries, including Japan, had reached out to the White House about tariff discussions.

Meanwhile, the benchmark Financial Revenues for 10 Years ascended past the 4% level, despite Trump’s tariffs amplifying concerns about a potential recession affecting the US economy.

“We’re focused on offering a variety of services to our clientele,” stated Louis Navellier, founder and chief investment officer of Navellier & Associates. “Treasury yields are a strong sign that recession fears have been overstated, and possibly a reflection that the Fed won’t implement emergency cuts. Additionally, Trump’s approach may not be as detrimental as suggested.”

Regardless, the S&P 500 has declined more than 10% over the last three trading days. The CBOE Volatility Index – regarded as the fear gauge for Wall Street – surged to approximately 60 on Monday.

Highlighting upcoming economic data, the National Federation of Independent Businesses is set to release a reading of the March Small Business Index on Tuesday. Additionally, the Consumer Price Index report is due later this week.